Introduction

The world of cryptocurrency has been in the spotlight for quite some time now, and Bitcoin is undoubtedly the star of the show. In this article, we will delve into the factors that make Bitcoin so expensive and sought after. From its unique properties to the market dynamics and speculative nature, we will explore the various reasons behind Bitcoin’s soaring price.

2023.11.9 Asic Miner Value

| Model | Release | Hashrate | Power | Noise | Algo | Profitability |

Oct 2023 | 9.4Th/s | 3500W | 75db | KHeavyHash | $166.43/day | |

Aug 2023 | 8.3Th/s | 3188W | 75db | KHeavyHash | $146.68/day | |

Sep 2023 | 8Th/s | 3200W | 75db | KHeavyHash | $141.01/day | |

Oct 2023 | 6Th/s | 3400W | 75db | KHeavyHash | $102.88/day | |

Sep 2023 | 2Th/s | 1200W | 75db | KHeavyHash | $34.10/day | |

Sep 2023 | 1Th/s | 600W | 75db | KHeavyHash | $17.05/day | |

Feb 2024 | 335Th/s | 5360W | 50db | SHA-256 | $12.77/day | |

Sep 2023 | 212kh/s | 1350W | 75db | RandomX | $7.58/day | |

Nov 2021 | 9.5Gh/s | 3425W | 75db | Scrypt | $7.27/day | |

Feb 2022 | 9.3Gh/s | 3425W | 75db | Scrypt | $6.91/day | |

Feb 2024 | 200Th/s | 3550W | 75db | SHA-256 | $6.76/day | |

Nov 2021 | 9.16Gh/s | 3425W | 75db | Scrypt | $6.65/day | |

Feb 2022 | 9.05Gh/s | 3425W | 75db | Scrypt | $6.46/day | |

Oct 2022 | 255Th/s | 5304W | 50db | SHA-256 | $6.19/day | |

Feb 2022 | 8.8Gh/s | 3425W | 75db | Scrypt | $6.00/day |

The Genesis of Bitcoin

A Digital Revolution

When Bitcoin was introduced by an anonymous entity known as Satoshi Nakamoto in 2009, it marked a revolutionary shift in the way we perceive and utilize currency. It was designed to be a decentralized digital currency, free from the control of traditional financial institutions.

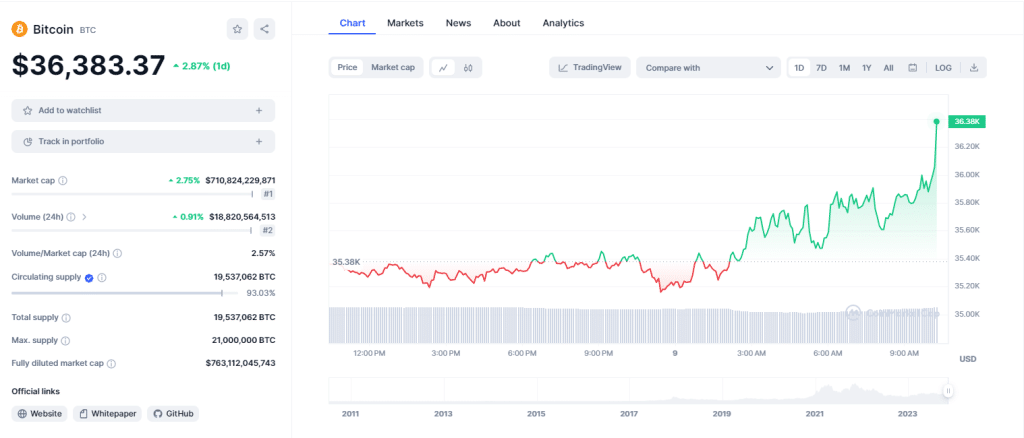

Limited Supply

A defining characteristic of Bitcoin lies in its restricted availability, with a fixed total of 21 million Bitcoins slated for existence, underscoring its status as a finite asset. This scarcity has a direct impact on its price.

Store of Value

Digital Gold

Bitcoin is often referred to as “digital gold” because, like the precious metal, it is considered a store of value. Investors flock to Bitcoin as a hedge against economic uncertainties and inflation.

Halving Events

Approximately every four years, a Bitcoin halving event occurs, reducing the number of new Bitcoins generated through mining. This event further reduces the supply and increases demand, driving up the price.

Speculation and Demand

Investment Mania

The growing interest in Bitcoin as an investment vehicle has led to a significant increase in demand. Many individuals and institutions view it as a potential high-return asset.

Institutional Adoption

Prominent financial establishments and major corporations have increasingly turned to Bitcoin as a part of their investment portfolio. Their endorsement legitimizes the cryptocurrency and encourages more investors to follow suit.

Network and Security

Decentralization

Bitcoin’s decentralized nature is a crucial factor in its high value. Bitcoin functions on a peer-to-peer network structure, effectively bypassing the necessity for intermediaries and lowering the associated transaction expenses.

Security Measures

Blockchain technology, the underlying technology of Bitcoin, provides a high level of security and transparency. This reassures investors, leading to greater adoption.

The Role of Public Perception

Media Coverage

Extensive media coverage has helped create a buzz around Bitcoin, sparking public interest and driving demand.

Fear of Missing Out (FOMO)

The fear of missing out on potential profits has driven many people to invest in Bitcoin, contributing to its price surge.

Conclusion

In conclusion, Bitcoin’s expensive nature can be attributed to its unique properties, limited supply, store of value, speculation, institutional adoption, network security, and public perception. As this digital currency continues to evolve, its price is likely to remain a topic of discussion.

FAQs

1.Is Bitcoin’s price only driven by speculation?

No, Bitcoin’s price is influenced by a combination of factors, including limited supply, institutional adoption, and network security.

2.Can Bitcoin’s price crash suddenly?

While Bitcoin is known for its price volatility, sudden crashes are rare, thanks to its growing adoption and investor interest.

3.How can I invest in Bitcoin?

You can invest in Bitcoin by purchasing it through cryptocurrency exchanges or investment platforms.

4.What is the significance of the 21 million Bitcoin limit?

The limit of 21 million Bitcoins ensures scarcity, which can contribute to price appreciation over time.

5.Should I consider Bitcoin as a long-term investment?

The decision to invest in Bitcoin as a long-term asset should be based on your financial goals, risk tolerance, and investment strategy.