Introduction

Over the past few years, there has been a notable surge in the global fascination surrounding digital currencies, marking a substantial increase in their widespread appeal. Bitcoin (Antminer S19 Pro,Antminer S19 XP, Antminer S19 XP Hydro…), Ethereum(Antminer E9 Pro), and other digital currencies have captured the attention of investors and enthusiasts worldwide. Alongside the growing interest in cryptocurrencies, a new method of acquiring these digital assets has emerged: crypto mining. This article aims to explore the differences between crypto mining and traditional investments, shedding light on why an increasing number of individuals are turning to digital gold.

Understanding Traditional Investments

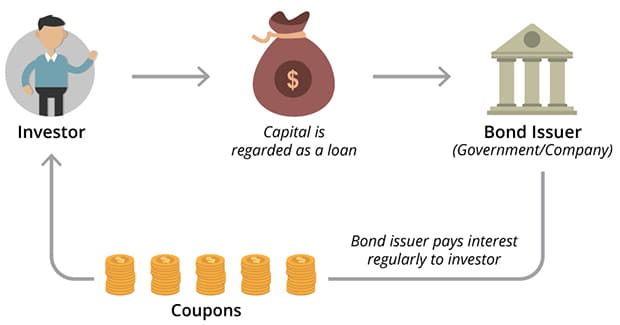

Traditional investments encompass a broad range of financial instruments such as stocks, bonds, mutual funds, and real estate. These investments have been the bedrock of wealth creation for decades, offering stability and long-term growth potential. Investors typically rely on established financial institutions and intermediaries to facilitate their investment activities.

Exploring Crypto Mining

Crypto mining involves the process of validating and recording transactions on a blockchain network, such as Bitcoin or Ethereum. Miners use powerful computers to solve complex mathematical problems, which secure the network and contribute to the creation of new cryptocurrency coins. In return for their computational efforts, miners receive a reward in the form of newly minted coins.

Cost and Accessibility

One of the primary reasons why more people are turning to crypto mining is the relatively low barrier to entry. While traditional investments often require significant capital, mining can be started with modest investments in mining equipment. This accessibility allows individuals from various economic backgrounds to participate in the cryptocurrency ecosystem.

Potential Returns

Crypto mining has the potential for substantial returns, especially during bull markets. As the value of cryptocurrencies increases, the rewards received by miners also rise. Additionally, mining provides an opportunity to accumulate cryptocurrencies without having to rely solely on purchasing them from exchanges. This can be particularly advantageous for early adopters of a new digital currency.

Flexibility and Control

Unlike traditional investments, crypto mining offers individuals greater flexibility and control over their financial activities. Miners have the freedom to choose which cryptocurrencies to mine, the mining pool to join, and when to sell their mined coins. This level of autonomy appeals to those who seek more active involvement in their investment strategies.

Security and Transparency

Blockchain technology, the underlying technology of cryptocurrencies, provides a high level of security and transparency. Transactions recorded on a blockchain are immutable and tamper-resistant, ensuring the integrity of the system. Additionally, the decentralized nature of cryptocurrencies eliminates the need for intermediaries, reducing the risk of fraud or manipulation.

Environmental Considerations

One aspect that often draws criticism to crypto mining is its energy consumption. Mining cryptocurrencies requires significant computational power, which translates into high energy consumption. However, as the industry evolves, there is a growing emphasis on developing more energy-efficient mining techniques, such as the adoption of renewable energy sources.

Regulatory Challenges

The regulatory landscape surrounding cryptocurrencies and mining is still evolving. Governments worldwide are grappling with how to address this new form of digital asset and its associated activities. While certain nations have welcomed the adoption of cryptocurrencies, others have implemented limitations or outright prohibitions on their usage.These regulatory uncertainties pose challenges for individuals considering crypto mining as an investment avenue.

Risk Factors

As with any investment, crypto mining comes with its share of risks. The volatile nature of cryptocurrencies can lead to substantial price fluctuations, impacting the profitability of mining operations. Additionally, the technological advancements and competition in the mining industry can render certain mining hardware obsolete, affecting mining efficiency and returns.

Future Outlook

The future of crypto mining and traditional investments is intertwined with the ongoing advancements in blockchain technology and the wider adoption of cryptocurrencies. As the industry matures, we can expect to see greater regulatory clarity, improved mining techniques, and increased mainstream acceptance of cryptocurrencies as viable investment assets.

Conclusion

Crypto mining presents a compelling alternative to traditional investments, attracting more individuals to participate in the world of digital gold. With its accessible entry point, potential for high returns, flexibility, and transparency, crypto mining offers a unique investment avenue. However, it is essential to weigh the associated costs, regulatory challenges, and risk factors before embarking on a mining venture.

FAQs

1. What is the difference between crypto mining and traditional investments?

Crypto mining involves validating transactions on a blockchain network, whereas traditional investments refer to investments in stocks, bonds, and real estate.

2. Is crypto mining accessible to everyone?

Yes, crypto mining has a relatively low barrier to entry, allowing individuals from different economic backgrounds to participate.

3. Can crypto mining be profitable?

Crypto mining has the potential for significant profits, especially during bull markets. However, market volatility and other factors can impact profitability.

4. How does crypto mining contribute to blockchain security?

Crypto mining involves solving complex mathematical problems, which secures the blockchain network and prevents fraudulent activities.

5. What are the environmental concerns associated with crypto mining?

Crypto mining requires substantial energy consumption. However, the industry is exploring energy-efficient mining techniques and renewable energy sources.