Cryptocurrency has brought about a paradigm shift in the realm of finance and digital transactions, transforming the way we conduct monetary exchanges in the modern era. It has gained immense popularity over the years, transforming the way we perceive and use money.Within the confines of this article, we shall embark on an enlightening journey into the realm of cryptocurrency, unearthing its essence, operational mechanisms, and the intricate technology that underpins its existence.

Introduction to Cryptocurrency

Cryptocurrency stands as a digitized or virtual manifestation of currency, harnessing the power of cryptography to safeguard financial transactions with utmost security. Diverging from conventional currencies governed by central banks, cryptocurrencies embrace a decentralized nature and thrive upon a groundbreaking technology known as blockchain.

The Birth of Cryptocurrency

The concept of cryptocurrency originated with the introduction of Bitcoin in 2009 by an anonymous person or group of people known as Satoshi Nakamoto. Bitcoin served as the catalyst for the emergence and subsequent proliferation of a multitude of alternative cryptocurrencies, commonly known as altcoins, shaping the landscape of digital currency in profound ways.

How Does Cryptocurrency Work?

Cryptocurrencies work through a decentralized network of computers, known as nodes, that maintain a shared ledger called the blockchain. Transactions made using cryptocurrencies are recorded on the blockchain, ensuring transparency and security.

When a user initiates a transaction, it is verified by the network of nodes through complex mathematical algorithms. After verification, the transaction gets included in a block and attached to the blockchain. This process, known as mining, requires significant computational power and incentivizes miners with cryptocurrency rewards.

Blockchain Technology: The Backbone of Cryptocurrency

Blockchain technology forms the foundation of cryptocurrency. It is a distributed ledger that records all transactions across multiple computers or nodes. The utilization of blockchain technology guarantees the utmost security, transparency, and immutability of transactions, providing a robust framework that safeguards the integrity of digital exchanges.

Each block in the blockchain contains a set of transactions, and each new block is linked to the previous one through cryptographic hashes, creating an immutable chain of transaction history. This decentralized nature eliminates the need for intermediaries such as banks, enabling peer-to-peer transactions.

Key Characteristics of Cryptocurrency

Cryptocurrencies exhibit a multitude of distinctive attributes that distinguish them from conventional fiat currencies, setting them on an innovative trajectory within the realm of financial systems.

- The concept of decentralization lies at the core of cryptocurrencies, as they function on a distributed network, effectively removing the necessity for central authorities.

- Security: Cryptocurrencies utilize cryptography to ensure secure transactions and protect against fraud.

- Anonymity: While transactions are recorded on the blockchain, users’ identities remain pseudonymous.

- Restricted Availability: The majority of cryptocurrencies possess a pre-established upper limit on their supply, guaranteeing scarcity and potentially amplifying their worth.

- Global Accessibility: Cryptocurrencies can be accessed and used by anyone with an internet connection, bypassing geographical limitations.

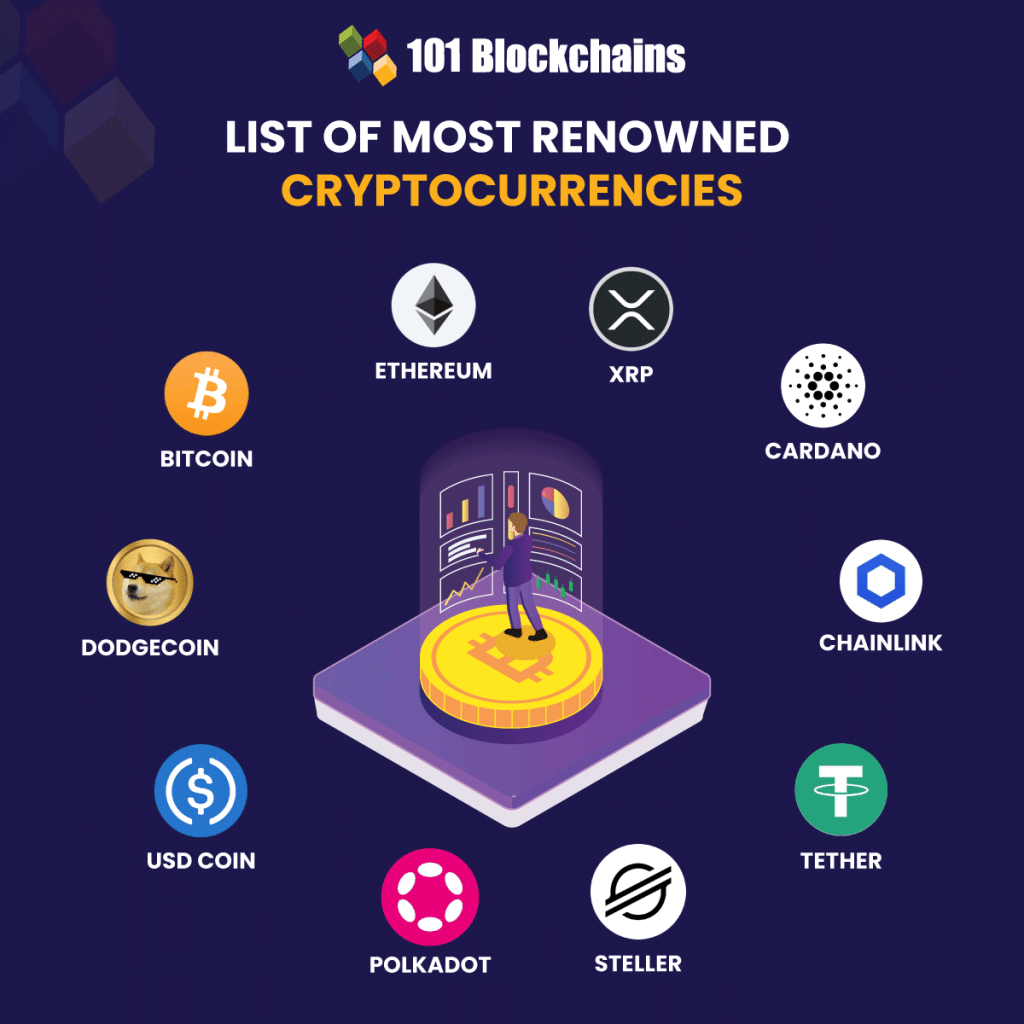

Types of Cryptocurrency

There is a wide variety of cryptocurrencies available today, each with its unique features and use cases. Some prominent examples include:

- Bitcoin (BTC): The pioneer and widely recognized cryptocurrency, frequently acknowledged as the embodiment of digital gold.

- Ethereum (ETH): A blockchain-based platform empowering the creation of decentralized applications (dApps) and smart contracts.

- Ripple (XRP): A cryptocurrency designed for fast and low-cost international money transfers.

- Litecoin (LTC): Frequently regarded as the counterpart to Bitcoin’s gold, Litecoin provides swifter confirmation times for transactions.

- Bitcoin Cash (BCH): A fork of Bitcoin that aims to facilitate faster and cheaper transactions.

- Cardano (ADA): A blockchain platform focused on security and scalability, enabling the development of complex smart contracts.

- Stellar (XLM): A cryptocurrency that aims to facilitate cross-border payments and enable financial inclusion.

- Polkadot (DOT): An innovative multi-chain platform that facilitates seamless interoperability and seamless information sharing among diverse blockchains.

Advantages of Cryptocurrency

Cryptocurrencies provide numerous benefits when compared to conventional financial systems:

- Enhanced Security and Privacy: Cryptocurrencies employ sophisticated cryptographic methods to guarantee transaction security and safeguard the confidentiality of users.

- Fast and Efficient Transactions: Cryptocurrency transactions can be processed quickly, especially when compared to traditional banking systems that involve intermediaries and clearance times.

- Lower Transaction Fees: Cryptocurrencies often have lower transaction fees compared to traditional banking or remittance services, making them attractive for international transactions.

- Financial Inclusion: Cryptocurrencies have the potential to provide financial services to the unbanked and underbanked populations worldwide, enabling greater financial inclusion.

- Ownership and Control: Cryptocurrencies give individuals full control over their funds, eliminating the need for third-party intermediaries and reducing the risk of censorship or freezing of assets.

Challenges and Risks Associated with Cryptocurrency

While digital currencies present a myriad of advantages, it is imperative to acknowledge the presence of certain hurdles and risks:

- Price Instability: Cryptocurrencies are renowned for their inherent volatility, leading to substantial fluctuations in their valuation.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies is still evolving, and changes in regulations can impact their usage and acceptance.

- Security Risks: While cryptocurrencies are built on secure technologies, there is still a risk of hacking, fraud, and theft. It is essential for users to adopt robust security measures to protect their digital assets.

- Lack of Adoption: Despite the growing popularity of cryptocurrencies, widespread adoption is still limited, which can affect their utility and value.

The Future of Cryptocurrency

The future of cryptocurrency holds great potential. As technology advances and awareness increases, cryptocurrencies may become more mainstream and integrated into various industries. The development of scalable and energy-efficient blockchain solutions will be crucial for their widespread adoption. Additionally, central banks and governments are exploring the concept of central bank digital currencies (CBDCs), which could further legitimize and integrate cryptocurrencies into the existing financial ecosystem.

Conclusion

Cryptocurrency has emerged as a disruptive force in the financial world, offering decentralized, secure, and efficient means of conducting transactions. With the advancement of blockchain technology and increasing acceptance, cryptocurrencies are poised to reshape the way we perceive and use money. However, it is essential to stay informed, exercise caution, and adopt best practices when engaging with cryptocurrencies to navigate the evolving landscape successfully.

Come and visit our website, to find what your need here.

Frequently Asked Questions (FAQs)

Q: How do I acquire cryptocurrency?

A: Cryptocurrency can be acquired through various means, such as purchasing from cryptocurrency exchanges, participating in initial coin offerings (ICOs), or receiving them as payment for goods and services.

Q: Are cryptocurrencies legal?

A: The legal status of cryptocurrencies varies from country to country. Some nations have embraced cryptocurrencies, while others have imposed restrictions or bans. It is essential to understand the regulations in your jurisdiction.

Q: Can I mine cryptocurrencies?

A: Mining cryptocurrencies requires significant computational power and specialized equipment. While it may be feasible for certain cryptocurrencies, it is not practical for all, considering the energy and hardware costs involved.

Q: Are cryptocurrencies secure?

A: Cryptocurrencies utilize advanced cryptographic techniques to ensure security. However, users must also take precautionsto secure their digital wallets and employ best practices such as using strong passwords and enabling two-factor authentication.

Q: Can I use cryptocurrency for everyday transactions?

A: The acceptance of cryptocurrency for everyday transactions is increasing, with many merchants and online platforms now allowing cryptocurrency payments. However, it is still not as widely accepted as traditional fiat currencies.

Get Access Now: https://bit.ly/J_Umma

In conclusion, cryptocurrency is a revolutionary form of digital currency that operates on decentralized networks and utilizes blockchain technology. It offers advantages such as security, fast transactions, and financial inclusion, but also comes with challenges and risks. The future of cryptocurrency looks promising as technology advances and awareness grows. By staying informed and adopting best practices, individuals can navigate the evolving landscape of cryptocurrency successfully.

The TOP 10 Miners Profitability Asic Miner

Bitmain Antminer KS3 (8.3Th), Jasminer X16-P, ForestMiner EPU XC, Bitmain Antminer E9 Pro (3.68Gh), iPollo V1, Jasminer X4, Bitmain Antminer E9 (2.4Gh), Jasminer X16-Q, iPollo V1 Classic, Jasminer X4-Q.