At the outset of the week, Bitcoin witnessed a surge in investor sentiment, yet three significant factors have thwarted its journey toward reclaiming the $30,000 threshold.

On October 2nd, Bitcoin’s price, currently at $27,684, experienced an intraday upswing of 5.5%, reaching $28,600. However, this bullish momentum fizzled out as the eagerly awaited launch of Ether futures exchange-traded funds (ETFs) failed to generate substantial trading activity.

While the recent rally towards the upper boundary of its current price range offered some encouragement to investors, recent statements from officials at the United States Federal Reserve rekindled concerns about an impending economic downturn.

On October 3rd, Bitcoin demonstrated short-term resilience by holding support at $27,200, eventually surging past $27,500 on October 5th. Nonetheless, three critical trading indicators point to a lackluster level of support, encompassing spot market volumes, derivatives, and confidence in the approval of a spot Bitcoin ETF.

Macroeconomic pressures weigh on Bitcoin’s price

On October 2nd, Michael Barr, U.S. Federal Reserve Vice Chair for Supervision, expressed his expectation of a slowdown in economic growth, citing higher interest rates as a constraint on economic activity. He also highlighted that the full impact of current monetary policies remains unrealized. The market’s outlook on the possibility of another Fed interest rate hike in 2023, according to the CME FedWatch tool, is currently evenly split.

On October 3rd, the real yield on U.S. 10-year Treasurys, adjusted for inflation, reached 2.47%—its highest level in nearly 15 years, as reported by the U.S. Treasury Department. This partly explains the U.S. Dollar Index (DXY) hitting a 10-month high.

Furthermore, Reuters reported that the United States has become a comparatively more attractive investment destination due to its ‘resilient economy,’ boasting stronger growth prospects compared to Europe and China.

Bitcoin trading metrics depict reduced activity for leveraged long positions

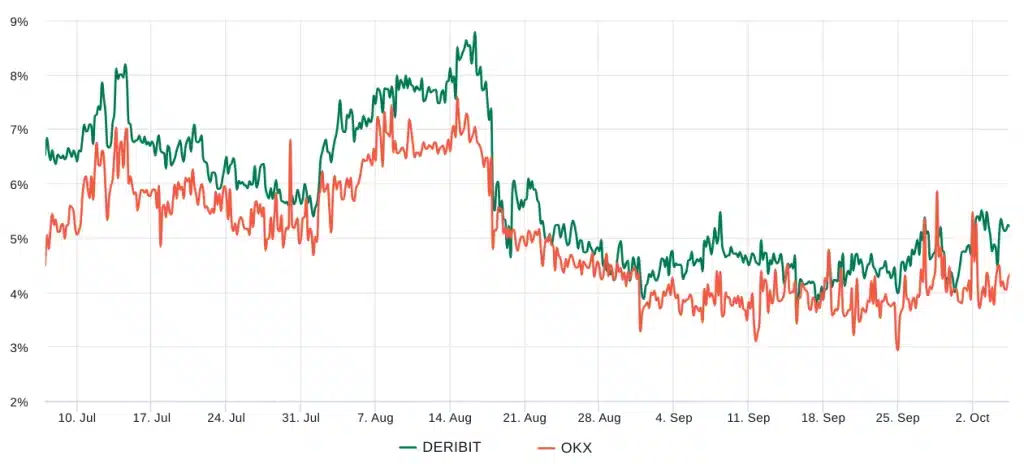

Bitcoin monthly futures typically trade at a slight premium to spot markets, indicating sellers’ demand for a higher price to postpone settlement. As a result, BTC futures contracts usually exhibit a 5% to 10% annualized premium—a scenario known as contango, which is not unique to crypto markets.

Bitcoin 2-month futures annualized premium. Source: Laevitas

The BTC futures premium remains below the 5% neutral threshold, consistently residing in the neutral-to-bearish range. This suggests a lack of interest in leveraged long positions.

Additionally, spot trading activity on traditional exchanges has plummeted to levels last witnessed in late 2020, indicating decreased participation by institutional investors.

Bitcoin daily spot trading volume, USD. Source: Messari and Kaiko

It is worth noting that the decline in trading volumes may be attributed to major U.S.-based trading firms, including Jane Street Group and Jump Trading, distancing themselves from the cryptocurrency markets ahead of May 2023. Bloomberg reported that the primary reason for this shift was ‘heightened regulatory scrutiny,’ which made the market less appealing to institutional investors.

Investor expectations for a spot BTC ETF approval wane

One of the factors fueling Bitcoin’s 68% gains in 2023 is the anticipation of the U.S. Securities and Exchange Commission’s approval of a spot Bitcoin ETF. However, despite the regulator’s numerous delays, the recent introduction of Ether futures-based ETFs on October 2nd saw lackluster demand.

Furthermore, despite a favorable court ruling allowing the conversion of the Grayscale Bitcoin Trust into a spot Bitcoin ETF, it continues to trade at a 19% discount compared to its Bitcoin holdings. This data reflects a lack of confidence in the approval of a spot Bitcoin ETF, as investors would have the option to redeem their shares at par value following the conversion.

In conclusion, Bitcoin struggled to breach the $28,500 resistance level amid warnings from Federal Reserve representatives about imminent economic pressures. Consequently, the near-term prospects of surpassing this resistance appear less favorable.