On January 10, the United States Securities and Exchange Commission (SEC) granted its approval for numerous spot Bitcoin exchange-traded funds (ETFs). As per an official filing by the SEC, these spot Bitcoin ETFs have received clearance for inclusion on all accredited national exchanges in the United States, including the Nasdaq, NYSE, and CBOE, concluding a ten-year quest for the introduction of such financial products.

This regulatory green light signifies that the ETFs are scheduled to commence trading on the CBOE starting at 9 am on January 11, coinciding with the opening of the U.S. stock market.

The SEC’s approval filing highlighted 11 issuers who were granted permission to list exchange-traded funds linked to Bitcoin (BTC). The announcement emerged in the late hours of January 10, albeit briefly disappearing, likely attributed to the substantial traffic on the SEC’s website.

“As described in more detail in the Proposals’ respective amended filings, each Proposal seeks to list and trade shares of a Trust that would hold spot bitcoin, in whole or in part. This order approves the Proposals on an accelerated basis.”SEC approval of spot BTC ETFs

Companies had expressed their preparedness to initiate trading as early as January 11. This affirmation came from VanEck CEO Jan Van Eck during an interview with CNBC. Other entities have also conveyed their capability to promptly commence spot Bitcoin ETF operations.

In the hours preceding the approval, both BlackRock and ARK 21Shares submitted amended applications, revealing even lower fees than previously stated. Currently, Bitwise holds the record for the lowest fees at 0.2%, followed by ARK 21Shares, BlackRock, and Fidelity in sequential order.

Despite the ongoing “fee war,” as highlighted by Bloomberg’s Eric Balchunas, it is uncertain how much impact these fees will have on the ultimate performance of these ETFs. Furthermore, it is unlikely that companies will alter their fee structures now that the SEC has given the green light for spot Bitcoin ETFs.

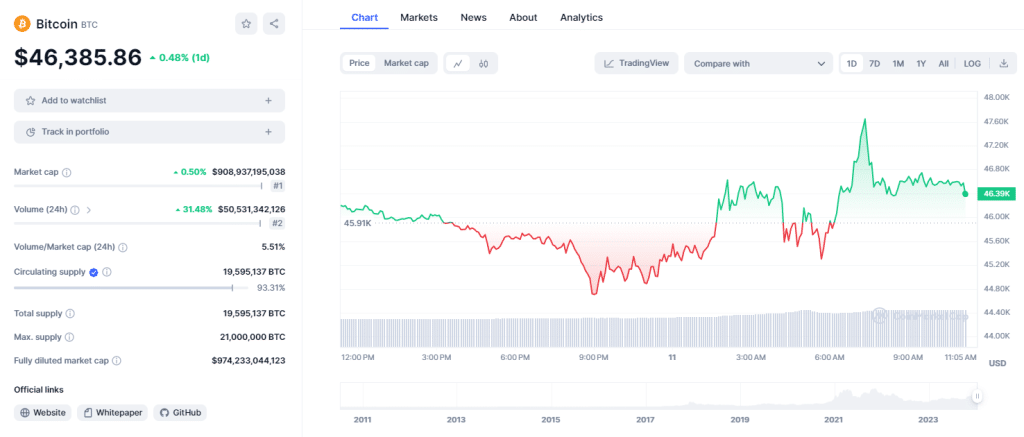

Following the SEC’s announcement of accepting multiple bids, the underlying asset, BTC, exhibited volatility and price fluctuations. At the time of the press, BTC was trading below $46,000, marking a decrease of over 2%.

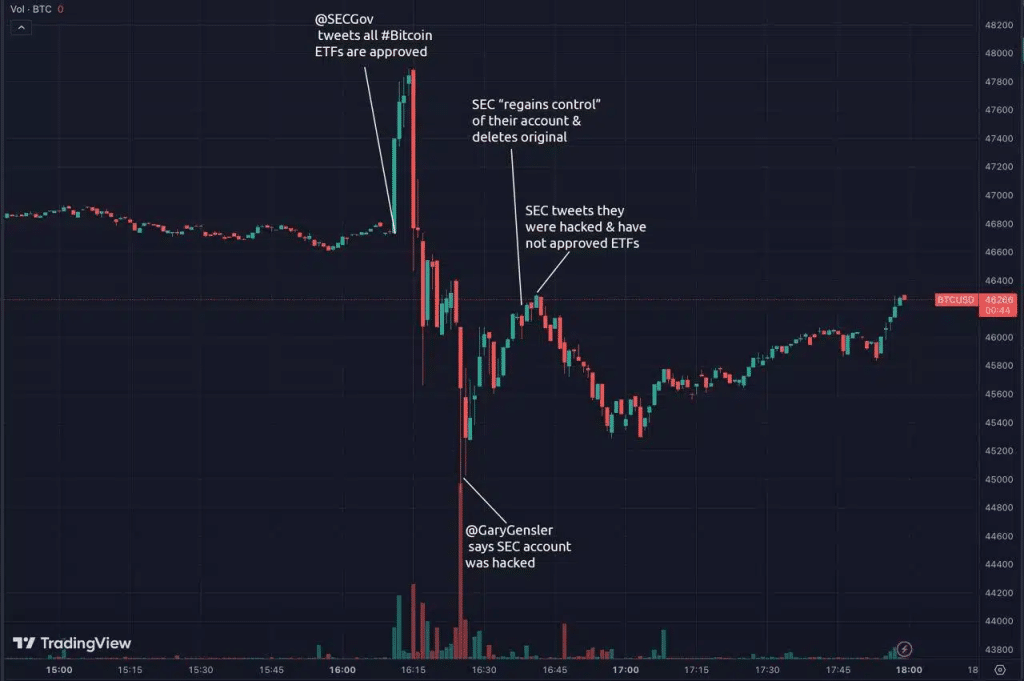

On January 9, the value of BTC underwent price fluctuations when a fraudulent spot BTC ETF approval message was posted on the SEC’s X account. SEC chair Gary Gensler explained that unknown hackers had compromised the page. This misleading information led to a 6% decrease in BTC’s price, resulting in the elimination of more than $230 million in cryptocurrency positions. According to Coinglass data, $90 million of that total was attributed to leveraged Bitcoin positions.

SEC attorneys have verified the forthcoming dissemination of an internal communication aimed at uncovering the root cause of what U.S. Senators are labeling a “significant error.” The FBI is reportedly engaged in investigations regarding this matter.

With the long-awaited approval of spot Bitcoin ETFs now secured, attention turns to the upcoming BTC halving in April and the capital inflows into these traditional finance (TradFi) investment vehicles linked to BTC. While established players on Wall Street, such as JP Morgan, anticipate a gradual capital interest, cryptocurrency-centric entities like Mike Novogratz’s Galaxy Digital foresee substantial price surges, with projections reaching up to 74%.

Addressing speculations that BTC markets could experience up to $100 billion in inflows in the first year, Bloomberg’s James Seyffart expressed more conservative expectations in the range of $10 billion to $15 billion. The ETF expert suggested that these flows might be distributed across new Bitcoin exposure and capital reallocation from other avenues, such as Canadian ETFs, crypto mining operations, and futures-based products.

Matthew Sigel, the head of VanEck’s digital asset research division, projects $2 billion in inflows in the first week and anticipates reaching $40 billion in assets under management within the initial year.

These figures remain subject to fluctuations influenced by various factors, including the upcoming 2024 U.S. presidential elections and potential changes in government across approximately 50 sovereign nations.

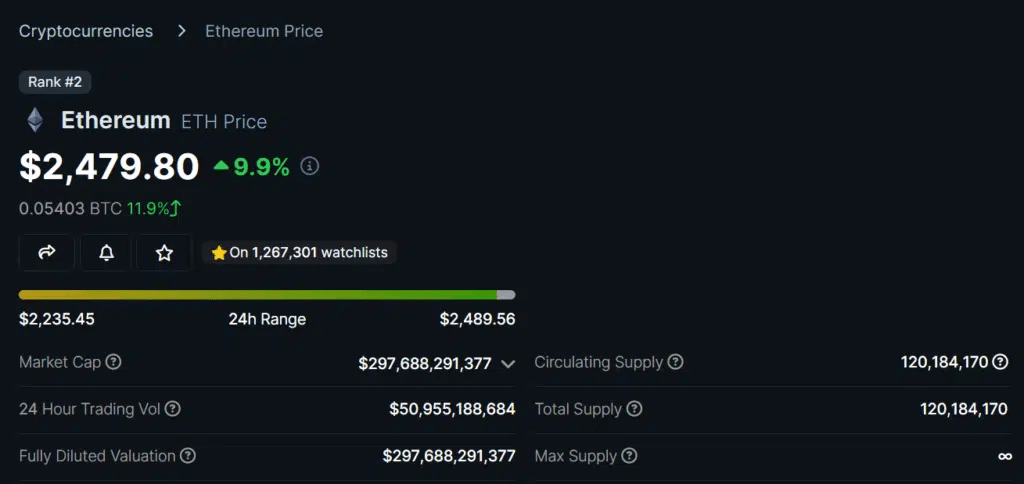

Attention is now shifting to Ethereum (ETH), which is experiencing its own ETF surge and upcoming technological advancements. ETH demonstrated resilience in the wake of a false Bitcoin ETF approval, registering a gain of over 9% in the past 24 hours.

By the way, we are asic miner supplier in china. Leed Technology Co., Ltd (Shenzhen Leed Electronic Co., Ltd ) is a leading supplier of asic miners founded in 2008 and entered the mining industry since 2017. With the development and expansion of the industry, we have become the first-class agent of Bitmain Antminer, Whatsminer, ICERIVER and Goldshell.