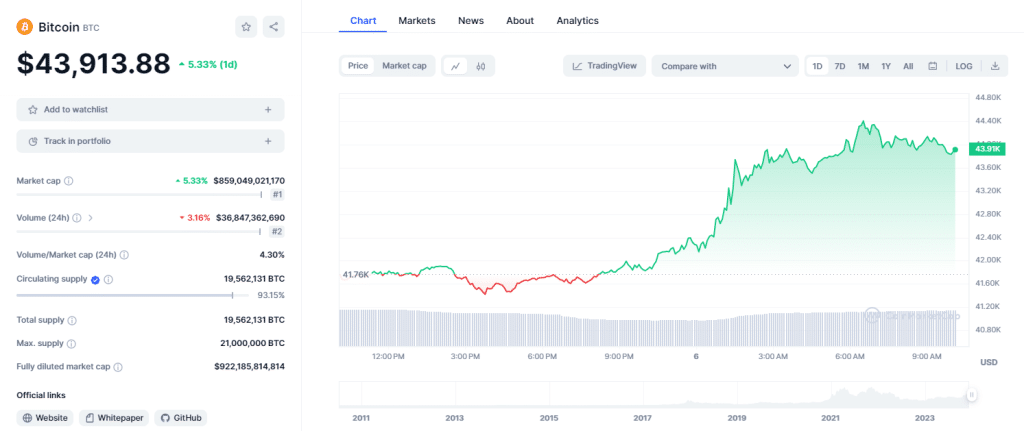

There was a news article in January 2023 “Goldman Sachs: Bitcoin will be the best-performing asset in the world in 2023”

According to internal Goldman Sachs documents posted on social media by Blockworks, Bitcoin will be the best-performing asset globally in 2023, surpassing gold, energy, the S&P 500 Index, real estate, the Nasdaq 100 Index, and the 10-year U.S. Treasury bonds.

As the price of Bitcoin rises, the prices of various brands of Bitcoin machines in the market also change accordingly. However, the supply and demand for Bitcoin machines in the market is limited, and machines are often sold out. If you have any need to purchase Bitcoin machines in the near future, please contact us and we will update you with the latest Bitcoin machine prices in a timely manner.

We can understand the reliability of information from the following points.

Look for supporting evidence:

Assess whether the prediction is backed by solid research, data, or analysis.

Market Volatility:

Cryptocurrency markets are known for their volatility. Predictions may be subject to rapid changes based on various factors, including regulatory developments, market sentiment, and technological advancements.

Diversification:

While a positive outlook on Bitcoin is interesting, it’s crucial to maintain a diversified investment portfolio. Relying solely on one asset class involves risks, and spreading investments across different assets can help manage these risks.

Stay Informed:

Keep abreast of market developments, news, and expert opinions. Markets can be influenced by a variety of factors, and staying informed can help you make well-informed decisions.

Long-Term Perspective:

Consider your investment goals and time horizon. Short-term predictions may not always align with long-term trends. Bitcoin and other cryptocurrencies have shown price volatility, so a long-term perspective is important.

Risk Tolerance:

Understand your risk tolerance and financial situation before making any investment decisions. Cryptocurrency investments, including Bitcoin, can be speculative and carry a level of risk.

Always remember that financial decisions should be made based on your individual circumstances and with careful consideration of the risks involved. Additionally, consulting with a financial advisor or conducting thorough research can provide valuable insights tailored to your specific situation.