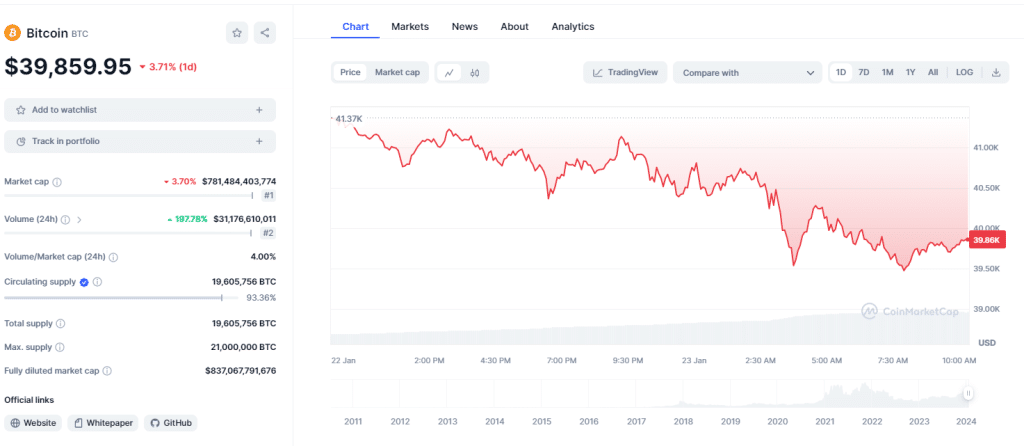

Bitcoins dips below $40k amid BTC ETF selloffs

Bitcoin experienced a decline below the $40,000 mark as a result of sell-offs in GBTC from the insolvent crypto exchange FTX and the withdrawal of BTC deposits on Coinbase initiated by the spot BTC ETF issuer Grayscale. On January 22, Bitcoin (BTC) witnessed a nearly 9% decrease, with its value hovering around $39,700 on platforms like Binance and Coinbase. The primary reason for this depreciation in the cryptocurrency’s value is attributed to the outflows from Grayscale’s spot Bitcoin ETF, a fund that is based on the company’s longstanding GBTC product.

Crypto Clash: FTX's $1 Billion Windfall and the Surprising Twist in GBTC's Journey

GBTC stands out as the most prominent spot BTC ETF in the United States, boasting a substantial market presence with assets under management exceeding $20 billion. Since the Securities and Exchange Commission (SEC) greenlit exchange-traded funds tracking spot Bitcoin prices, GBTC has witnessed daily outflows reaching up to $500 million, resulting in a substantial withdrawal of over $2.8 billion from the fund.

Given that these ETFs are backed by actual Bitcoins, Grayscale has taken steps to send BTC to exchanges for the purposes of liquidation and redemption. According to crypto.news, Grayscale has deposited 52,227 BTC, valued at an estimated $2.2 billion, into Coinbase Prime accounts from its custodial wallets. Additionally, Grayscale’s GBTC Bitcoin holdings are also maintained with Coinbase.

A noteworthy departure from GBTC, disclosed on January 22, comes from the now-defunct crypto exchange FTX. Operating under the administration of bankruptcy administrator and CEO John J. Ray III, FTX’s estate has successfully sold millions of GBTC shares, generating $1 billion in revenue.

In a related development, the FTX-affiliated crypto hedge fund Alameda Research has voluntarily withdrawn its lawsuit against Grayscale and its parent company, Digital Currency Group. The lawsuit, which alleged internal malpractice, aimed to unseal $9 billion on behalf of FTX debtors.

On a different front, the SEC has acknowledged Nasdaq’s request for spot BTC ETF options. These derivatives provide traders with the opportunity to speculate on asset volatility or hedge against it, potentially attracting more capital into Bitcoin ETFs.

Leed Technology Co., Ltd (Shenzhen Leed Electronic Co., Ltd ) is a leading supplier of asic miners founded in 2008 and entered the mining industry since 2017. With the development and expansion of the industry, we have become the first-class agent of Bitmain Antminer, Whatsminer, Avalon and Goldshell.

This asset is remarkable. The wonderful substance shows the designer’s enthusiasm. I’m astounded and envision more such fabulous material.

This platform is phenomenal. The magnificent data uncovers the manager’s excitement. I’m shocked and expect additional such fabulous posts.

Hey there You have done a fantastic job I will certainly digg it and personally recommend to my friends Im confident theyll be benefited from this site

I do not even know how I ended up here but I thought this post was great I dont know who you are but definitely youre going to a famous blogger if you arent already Cheers.

I have been surfing online more than 3 hours today yet I never found any interesting article like yours It is pretty worth enough for me In my opinion if all web owners and bloggers made good content as you did the web will be much more useful than ever before.

I’ve been visiting this site for years, and it never fails to impress me with its fresh perspectives and wealth of knowledge. The attention to detail and commitment to quality is evident. This is a true asset for anyone seeking to learn and grow.

Thank you for your response! I’m grateful for your willingness to engage in discussions. If there’s anything specific you’d like to explore or if you have any questions, please feel free to share them. Whether it’s about emerging trends in technology, recent breakthroughs in science, intriguing literary analyses, or any other topic, I’m here to assist you. Just let me know how I can be of help, and I’ll do my best to provide valuable insights and information!

I wanted to take a moment to commend you on the outstanding quality of your blog. Your dedication to excellence is evident in every aspect of your writing. Truly impressive!