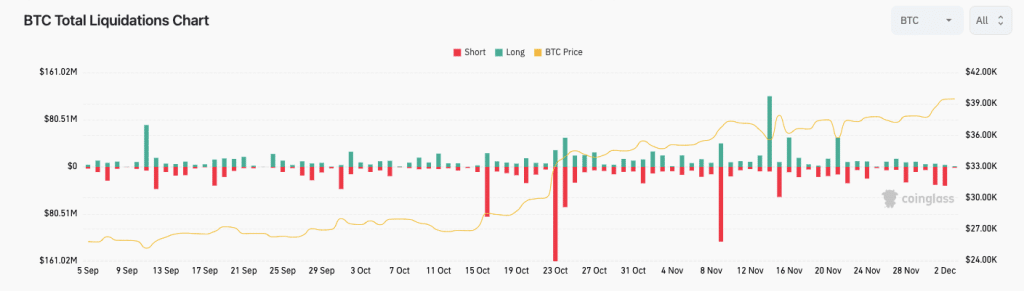

Bitcoin outpaces sellers, successfully liquidating $60 million worth of short positions within a span of two days, as the BTC price hovers just a few hundred dollars shy of the $40,000 mark.

Bitcoin caught shorts off guard, as $60 million worth of positions were left hanging.

Data from Cointelegraph Markets Pro and TradingView reported a recent surge in BTC prices, propelling BTC/USD to new 2023 highs of $41,502.

This surge built upon the upward momentum initiated in the preceding days, marking the first time Bitcoin reached $41,502 since mid-2022. As derivatives approached the conclusion of the Wall Street trading week, analysts anticipated spot buyers to sustain the momentum. However, an unforeseen development occurred with a sudden surge across Bitcoin and altcoins, erasing previous resistance.

Coverage on X (formerly Twitter) included insights from popular trader Skew, who suggested that “someone just ran all shorts across the board seemingly on most pairs.” This action raised questions about BTC price behavior around the weekly open, particularly since CME Bitcoin futures closed the week at $39,225, leaving a gap between that and the spot price, typically expected to be “filled” through a dip.

Despite the conventional analysis, trader Daan Crypto Trades argued that this time might be different. According to their perspective, during strong trends, especially when Bitcoin is at yearly highs or in price discovery, weekend moves often occur, breaking out and leaving many behind. These moves can create a gap that may not be closed until weeks later, challenging the conventional expectation of an immediate correction.

Daan Crypto Trades concurred that the region encompassing the Friday closing price presented a chance to ensnare those betting against the market.

“With the anticipation of a significant weekend movement, I refrained from sharing the typical CME chart. Thus far, the hunch has proven accurate, and individuals attempting to short this surge would have faced substantial losses,” he stated.

Information gleaned from the statistical source CoinGlass indicated approximately $30 million in Bitcoin shorts were liquidated on both December 1 and December 2.

As the price of Bitcoin continues to rise, the prices of various asicminer machines are also constantly changing. The number of bitcoin miner machines in the market is limited, first come, first served. If you would like to know more details about asic miner machine, welcome to cotnact us directly.