Summary

As cryptocurrency mining matures, miners are becoming far more selective about which projects deserve long-term commitment. Short-lived hype coins may generate brief spikes in profitability, but they rarely offer sustainable returns. This is where INIV (Initverse) stands apart.

Rather than existing purely as a speculative asset, INIV is designed as a utility-driven token that powers the Initverse ecosystem—a growing network focused on virtual worlds, digital assets, and creator-driven economies. For miners, this distinction matters. Utility creates demand, and demand underpins long-term mining viability.

This guide explores INIV mining from a miner’s perspective, covering how Initverse works, why specialized ASIC miners matter, realistic profitability expectations, and whether INIV deserves a place in a serious mining portfolio.

What Is INIV (Initverse), and Why Does It Matter to Miners?

INIV is the native token of the Initverse ecosystem, functioning as the primary medium of exchange across all on-chain activities. Unlike fragmented ecosystems that rely on multiple tokens, Initverse consolidates value into a single asset—INIV.

Within the Initverse network, INIV is used for:

Digital asset and virtual item transactions

Creator rewards and incentive distribution

Access to ecosystem features and tools

Network fees and protocol-level interactions

From a mining standpoint, this unified utility model is critical. Every meaningful activity on the network depends on INIV, which translates into ongoing transaction volume and consistent network usage. For miners, this reduces reliance on pure speculation and ties mining rewards more closely to real ecosystem activity.

How the Initverse Network Supports Mining Value

Initverse relies on miner-provided computational power to secure the network and validate transactions. By contributing hash power, miners help maintain consensus and are rewarded in INIV.

Three structural elements make INIV particularly relevant for miners:

Single-token demand concentration All economic activity flows through INIV, reducing dilution and improving clarity around token value.

Usage-driven transaction flow As creators, users, and developers interact with Initverse, transaction frequency increases—supporting stable mining incentives.

Long-term infrastructure focus Initverse positions itself as a foundational platform rather than a short-term trend, aligning well with miners who operate on multi-year ROI timelines.

INIV Mining Hardware: Why ASIC Miners Are the Preferred Choice

Mining profitability is ultimately dictated by hardware efficiency. While general-purpose GPUs or CPUs may technically participate in INIV mining, specialized Initverse ASIC miners offer a clear advantage.

Key Advantages of Initverse ASIC Miners

Algorithm-Specific Optimization ASIC miners are engineered specifically for Initverse’s hashing requirements, delivering higher and more stable hash rates than general hardware.

Superior Energy Efficiency Lower power consumption per unit of hash rate significantly improves net profitability, especially for miners facing rising electricity costs.

Stronger Long-Term Competitiveness As network difficulty increases, GPU-based setups often become uncompetitive. ASIC miners are better suited to remain viable as total network hash power grows.

For miners entering the ecosystem, optimized INIV mining rigs can serve as an initial step. However, dedicated Initverse ASIC miners are the preferred solution for long-term operations.

Is INIV Mining Profitable in 2025? A Practical Overview

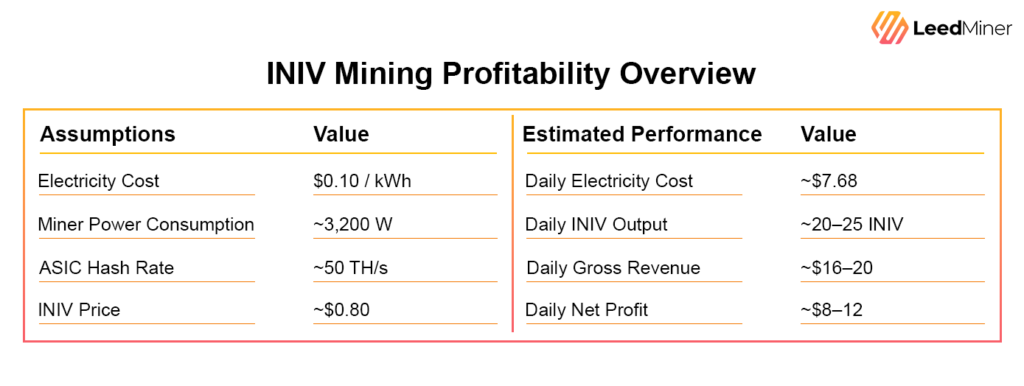

INIV Mining Profitability Overview

Under these conditions, hardware payback may fall in the 6–7 month range, depending on market and network dynamics.

What strengthens this model is not short-term price movement, but Initverse’s usage-driven demand structure, which supports mining sustainability beyond speculative cycles.

How to Start Mining INIV: Step-by-Step for Miners

Step 1: Select Appropriate Mining Hardware

Prioritize Initverse-compatible ASIC miners

Evaluate hash rate, energy efficiency, and cooling reliability

Plan for continuous 24/7 operation

Step 2: Set Up an INIV-Compatible Wallet

Use EVM-compatible wallets that support INIV

Cold wallets are recommended for long-term holding

Securely back up private keys and recovery phrases

Step 3: Join an INIV Mining Pool

Pools improve reward consistency for small and mid-scale miners

Look for transparent payout mechanisms and low fees

Step 4: Configure and Launch Mining Operations

Connect your miner to the network or pool

Monitor temperature, hash rate stability, and uptime

Adjust settings to optimize efficiency over time

Risks and Opportunities in INIV Mining

Key Risks

INIV market price volatility

Slower-than-expected ecosystem expansion

Increasing network difficulty reducing per-unit rewards

Potential Upside

New Initverse features increasing transaction volume

Broader exchange availability improving liquidity

Expansion of creator and virtual economy use cases

Miners who monitor ecosystem development—not just price charts—are better positioned to manage these variables.

Final Assessment: Is INIV Worth Mining?

INIV is not positioned as a short-term speculative mining opportunity. Instead, it represents a utility-backed, ecosystem-driven mining model.

For miners who value:

Long-term network relevance

Predictable hardware deployment cycles

Projects with real on-chain activity

Initverse (INIV) offers a compelling case as part of a diversified mining strategy.

Looking for the Right INIV Mining Hardware?

Mining success with INIV depends heavily on selecting the right ASIC solution. Evaluating hash efficiency, power consumption, and long-term reliability is essential before scaling operations. A well-matched Initverse ASIC miner can significantly improve both stability and ROI over time.