Bitcoin’s value is once again sliding, dipping below the critical $26,500 support level, and there’s a looming threat of further declines below the $26,000 mark in the short term.

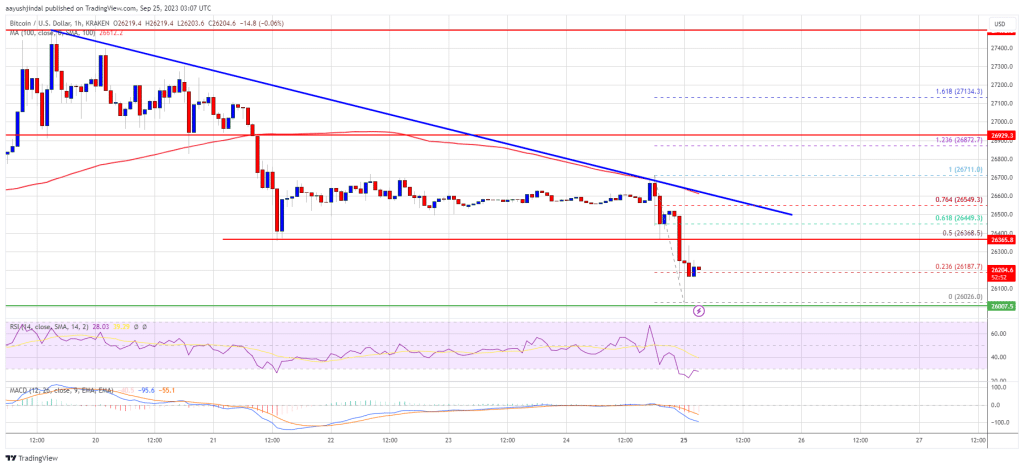

The decline in Bitcoin’s fortunes commenced when it stumbled in its attempt to surpass the stubborn $27,500 resistance. Presently, its value hovers beneath both $26,500 and the 100-hourly Simple Moving Average. Notably, an influential bearish trend line is taking shape, introducing resistance in the vicinity of $26,500, as evidenced by the hourly chart of the BTC/USD pair, with data sourced from Kraken. Consequently, the pair finds itself in a precarious position, facing the imminent prospect of more downward movements beneath the pivotal $26,000 level.

Bitcoin Price Drops Again

Following its inability to breach the $27,500 resistance, Bitcoin embarked on a fresh descent, slipping below the support levels of $27,000 and $26,500, firmly establishing its presence in the bearish territory. The descent also saw a dip below the $26,200 support level, eventually testing the $26,000 range. The price reached a low point at around $26,026, and it is currently in a consolidation phase, trading just above the 23.6% Fibonacci retracement level calculated from the recent decline spanning from the $26,711 peak to the $26,026 low.

Presently, Bitcoin is trading beneath the $26,500 level and the 100-hourly Simple Moving Average. The immediate hurdle on the upward path lies near the $26,350 mark. The primary resistance zone encompasses $26,500, along with an intersecting bearish trend line and the 61.8% Fibonacci retracement level derived from the recent descent originating from the $26,711 peak to the $26,026 nadir.

Source: BTCUSD on TradingView.com

The upcoming significant obstacle could materialize around the $26,700 threshold, and a breakthrough there may ignite a bullish upswing. In such a scenario, there’s potential for the price to ascend towards the $27,000 resistance. Further advances could even pave the way for a push towards the $27,500 level.

More Losses In BTC?

However, if Bitcoin struggles to initiate a fresh ascent beyond the $26,500 resistance, the downside journey may persist. Immediate support awaits near the $26,050 level.

The subsequent substantial support level looms in proximity to the $26,000 mark. A breach below and a close beneath $26,000 could usher in additional downtrends, potentially directing the price towards the ensuing support at $25,400 in the forthcoming trading sessions. Further declines might raise the prospect of testing the $25,000 threshold.

Technical indicators:

Hourly MACD – The MACD indicator is presently displaying deceleration within the bearish territory.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD has dipped below the 50 level.

Key Support Levels – $26,000, followed by $25,400.

Key Resistance Levels – $26,350, $26,500, and $26,700.