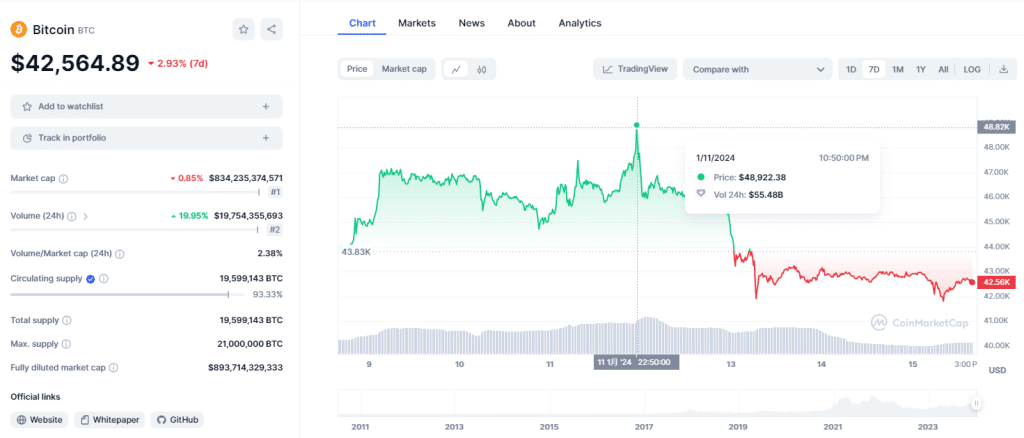

Following the approval of Bitcoin Spot ETFs, a downward trend has emerged, leading many analysts to view this as a “sell the news” scenario.

Today, BTC witnessed a nearly 10% decline, reaching the $41,500 mark. The cryptocurrency market experienced a substantial liquidation, totaling $93 million in the last hour. Long positions accounted for $86.81 million, while short positions amounted to $6.55 million.

Anthony Scaramucci, the founder of SkyBridge Capital, attributed Bitcoin’s recent downturn in part to the sale of Grayscale Bitcoin Trust shares. In a recent Bloomberg interview, Scaramucci highlighted significant selling activity in Grayscale, noting that his trading desk observed shareholders transitioning from the trust after the U.S. Securities and Exchange Commission approved ETFs. This transition involved selling to realize losses and shifting to alternatives with lower fees.

Nevertheless, Zach Pandl, Grayscale’s general manager of research, contended that the act of selling one Bitcoin product to acquire another should not impact the overall Bitcoin price. He emphasized that the potential approval of spot Bitcoin ETFs has been a topic of discussion since Grayscale’s legal victory last summer.

Pandl also highlighted that, following the substantial surge in Bitcoin’s valuation, it’s customary for investors to capitalize on profits by selling the asset. On Thursday, GBTC recorded an impressive $2.3 billion in volume, marking the highest first-day turnover ever for an ETF.

Simultaneously, Bitcoin achieved a milestone by surpassing $49,000 on that same day, reaching a two-year high before experiencing a decline to $41,500 on Friday.

Scaramucci disclosed that FTX’s bankruptcy estate initiated selling into the market following the ETF announcement, contributing to the existing heavy selling volume in Bitcoin. He anticipates the oversupply to normalize within the next six to eight trading days.

Additionally, Scaramucci pointed out that the current period is relatively quiet for Wall Street, and the marketing of these ETFs is expected to commence in about eight days.

*This information is not intended as investment advice.

For All ASIC Miner Customers, Our Spring Festival holiday lasts for 13 days, from February 4, 2024 to February 16, 2024. During the holidays, we can accept orders normally, but cannot ship during this time.

If you have purchase plans during this time period, we recommend that you arrange your order in advance so that we can better guarantee the timely delivery of your goods.

Welcome to contact us to know more details.